WHAT IS PORTFOLIO STRESS TESTING?

Stress Testing is about assessing the potential impact of economic scenarios (e.g. oil crash, inflation, etc.) on your portfolio and other investments.

In a Portfolio stress test, we construct “what if” scenarios based on real life macro-economic uncertainties, and measure their potential impact on your portfolio.

Portfolio stress testing is not about predicting the future, but about identifying and adjusting for downside risks.

Please continue to scroll down the page until you reach “Click to Start Free Analysis.”

UNCOVER

THE CONNECTIONS

We use economic research, historical records, statistical data, and quantitative analysis to measure millions of relationships between the economy and investments.

KEY ELEMENTS OF THE

PORTFOLIO STRESS TEST

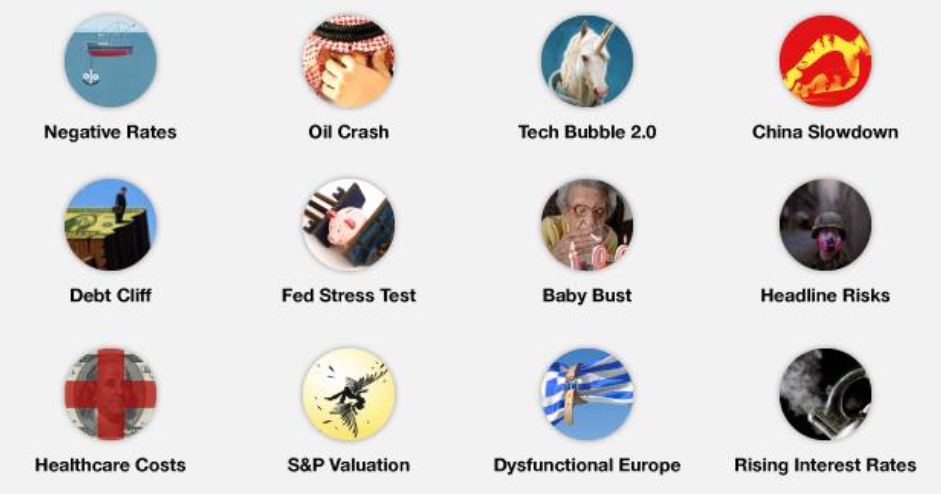

SCENARIOS

A scenario is a representation of a macro-economic or geopolitical event which has the potential to impact investment returns. We can design custom scenarios that reflect individual investor concerns, or apply our broad catalog of risk scenarios to a portfolio to identify risk factors.

LEVER ANALYSIS

Our platform tracks over 90 different economic factors including GDP growth and CPI, market data like commodities and currency prices, and industry-specific factors such as shipping rates and housing starts. Then, based on statistical correlations, it analyzes the effect of these factors on assets in your portfolio

ASSETS (MUTUAL FUNDS, STOCKS, ETC.)

Our stress test scenarios can be used with a wide range of asset classes including stocks, bonds, ETFs, mutual funds, closed-end funds, options, separately managed accounts, hedge funds, and non-traded REITs.

MEASURE RISKS AND OPPORTUNITIES BASED ON REAL DATA

We can apply a quantitative approach to test economic and market scenarios that may help you make more prudent investment and financial decisions.

UNCOVER THE HIDDEN RISK FACTORS IN YOUR PORTFOLIO

Assess your portfolio risk against a variety of economic and market economic scenario outcomes, covering a range of possible events such as:

Private Clients, Attorneys, CPAs, and Community Members look to us for proprietary

Reward-to-Risk investing disciplines, over 50 years of combined service in the "financial trenches,"

and authentic care and concern for real people.

Glenwood Financial Partners is an independent financial advisory

firm located in Raleigh, North Carolina.

Advisory services offered through Eudaimonia Partners LLC, an SEC registered investment advisory firm. Glenwood Financial Partners may only conduct business with residents of the states for which they are properly registered.