A bit of euphoria and performance chasing has crept into numerous financial markets. At the same time, tax-loss selling pressure, mutual fund redemptions, and other hidden risks remain. Thankfully, a disciplined approach to security selection and portfolio construction is still appreciated by prudent investors.

We believe 2017 market activity will produce a large performance disparity between winners and losers. The value of experienced stewardship should matter. We see an opportunity for proactive advice to shine over retrofit and overly standardized solutions.

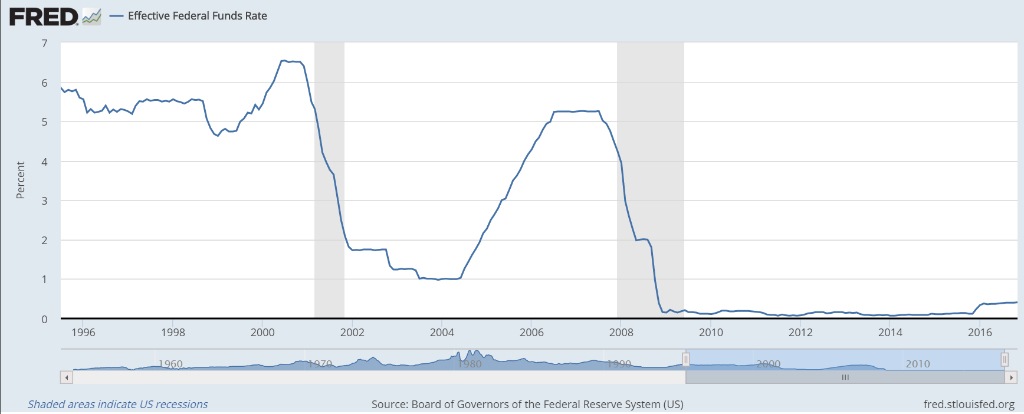

The U.S. Federal Reserve, led by Chair Yellen, meets eight times a year to determine the federal funds target rate via its Federal Open Market Committee (FOMC). The federal funds rate is the central interest rate in the U.S. financial market which influences other interest rates such as the prime rate and longer-term interest rates like mortgages, loans, and savings, all of which are very important to consumer wealth and confidence. The above chart shows today’s 0.40% effective Federal Funds level versus over 5% just 10 years ago.

December 14 marks the conclusion of the last official meeting of 2016 with a current consensus view that the FOMC will announce a slightly higher target for its federal funds rate. This meeting is associated with a Summary of Economic Projections and a press conference by the Chair. It’s no Super Bowl event; however, the financial world will certainly be especially tuned in to the announcement, prepared remarks, and the Q&A with members of the press.

Projections Are Difficult and Necessary

We consistently and, humbly, set out baseline expectations for forward 12-18 month interest rates, inflation, corporate earnings, global gross domestic products (GDPs), and other key performance indicators. Our investing backdrop also unemotionally observes the status of important macro factors like monetary conditions, reward-to-risk levels, investor psychology, and technicals/volatility.

TRUMP

Glenwood Financial Partners is not clear on what policies President-elect Trump will first pursue; however, a scenario with significant infrastructure packages, a reduction in corporate regulations, and a decrease in the corporate tax rate can certainly be interpreted as capital friendly.

Not so friendly are heavy-handed attacks on individual companies, sectors, and even our trading partners. Manufacturer’s, defense contractors, and drug companies have already fallen in the cross-hairs of Trump Twitter attacks. Trump’s use of social media will have an exponential impact on cage-rattling, stock prices, and general anxiety levels as he uses Facebook, Twitter, Instagram, Snapchat and other platforms as primary channels for direct communication to the public.

Impacts on Economy?

A corporate rate reduction from 35% to 25% has the potential to boost S&P 500 earnings by double-digits—Even without faster economic growth. On the other hand, tariffs, quotas or restrictions on trade have the potential to contribute quite negative reactions. Oxford Economics gained headlines with a “$1 trillion loss” study that found if fully implemented, Trump’s economic, tax and immigration policies would cost 4 million U.S. jobs, weigh down global growth and U.S. consumer spending, and could spark a trade war with other nations.

Interest-Rates

Have we finally seen the end of the 35-year secular downtrend in rates? As outlined in our previous update, global rates leapt forward after the U.S. presidential election results. Again, there is a lot of uncertainty about what policies will be enacted and any further impact on market interest rates.

The benchmark U.S. 10-Year Treasury Bond is 2.5% versus below 1.4% last summer and over 5% a decade ago. If rates move well above 3% without a corresponding positive increase in economic growth, it’s troublesome. If there is finally a boost in economic growth out of the recent malaise, a move above 3% could be tolerable or even welcomed by market participants.

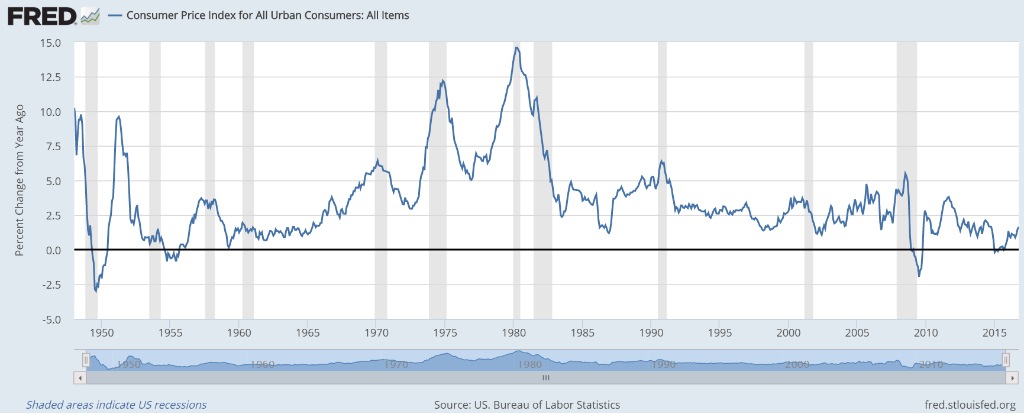

On the contrary, an inflation problem that the Federal Reserve feels compelled to counter with tighter monetary policy has historically presented a challenge to the stock market. The latest value in 10-Year breakeven rates implies that market participants’ inflation expectations have jumped 30% since September’s end.

Will Trump Shake Up the Federal Reserve?

The Federal Reserve is a powerful institution. Its actions, non-actions, and rhetoric influence global markets daily. President-elect Trump has criticized the Fed for being too “dovish” or easy on rates and on its unusual support mechanisms such as Quantitative Easing. Chair Yellen’s term runs through January 2018. Vice Chair Fischer’s term ends about six months later. Trump has given no indication that he will ask either to step down now, although he indicated that he wants to replace Yellen when he becomes president. Additionally, Trump will have the opportunity to fill two Federal Reserve governors appointments very early in his term.

Trump has criticized the Fed for keeping interest rates too low. However, he may need to welcome low rates if he wants to implement the infrastructure program that he desires. Rising interest rates could present more of a challenge to his pursuit of infrastructure projects, tax cuts, and other objectives. When rates rise, the government’s financing costs also rise.

For now, the consensus is that the FOMC will raise its federal funds target by .25% on December 14 to a level of roughly 0.75%; of course, the FOMC could stay put, as stranger things have happened thus far in 2016! Next year could bring anywhere from two to three hikes depending on the trajectory of market rates, domestic stimulus, inflation, and global events.

Oil Prices and Headline Inflation

One major driver of interest rates is the expectation for future inflation. Oil prices and its refinement into prices at the pump and factory inputs are important factors. The WTI (West Texas Intermediate) front-month oil contract is one of the most commonly used benchmarks for the price of oil. A wild ride, oil has seen $150 and $25 over the last 10 years. This year is no exception to volatility in oil with the price retreating early in the year to the mid-$20s and now pushing toward the mid-$50s.

Eleven major oil producers not affiliated with OPEC, including Russia and Mexico, recently agreed to cut their collective oil production in 2017 (remember, less supply is positive for the price). Together OPEC and these eleven oil producing nations have agreed to produce 1.8 million fewer barrels of oil every day in 2017, representing almost 2% of the world’s daily oil production!

We observe that a significant amount of economic forces such as a stronger U.S. dollar, an aging population, technology advances, and weak global demand tend to counter inflation. The below graph illustrates one government measure of inflation: Consumer Prices for All Urban Consumers: All Items. While this measure is edging higher, the Federal Reserve has said it is willing to tolerate inflation above 2.5% to allow the economy to get on more stable footing. Anything above that and they will likely be more aggressive about raising interest rates.

Overall Stock and Bond Returns

Since early November, U.S. stocks are UP and U.S. bond prices DOWN. We are not big fans of extrapolating the present broad view, and we remind our dear readers that our task is to gather, interpret and apply information on behalf of our clients’ unique circumstances and goals.

The Republicans control all three houses; however, GOP margins have been reduced in both the House and the Senate from the last Congress. So, while not all policy agendas are an easy pass, the opportunity to enact more capital-friendly regulations and tax policies, particularly for corporations, has certainly boosted stock prices since the presidential election.

The collective “stock and bond market,” which is comprised of varied constituents, seems already focused on Trump’s stimulus talk, but perhaps the post inauguration view and market activity will evolve in a less straight-line fashion.

At some point, investors will start to demand tangible evidence that optimism is justified (e.g. actual changes to regulations and the tax code as well as a targeted increase in near-term government spending). The first 100 days of the new presidency will deliver new information that will impact stock and bond returns.

Patience, Discipline, Process and Customization

The first view of our investing backdrop is to unemotionally observe the status of important macro factors like monetary conditions, reward-to-risk levels, investor psychology, and technicals/volatility. We interpret this information and establish informed baseline scenarios that includes capital market assumptions for stocks, bonds, commodities, currencies, and all sorts of economic levers.

We believe current stock (up) and bond (down) price trends may continue into February; however, it is prudent to expect change and manage assets with disciplined eyes toward longer-term focused capital preservation and risk management.

The information set forth herein is for informational purposes only and should not be used as the sole basis for an investment decision. While we have made every attempt to ensure that the information contained in this Site has been obtained from reliable sources, we are not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this Site is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied.