Clean Election? Legal Challenges? Gridlock?

???? ELECTION CHAOS?

???? Anything is possible in 2020!

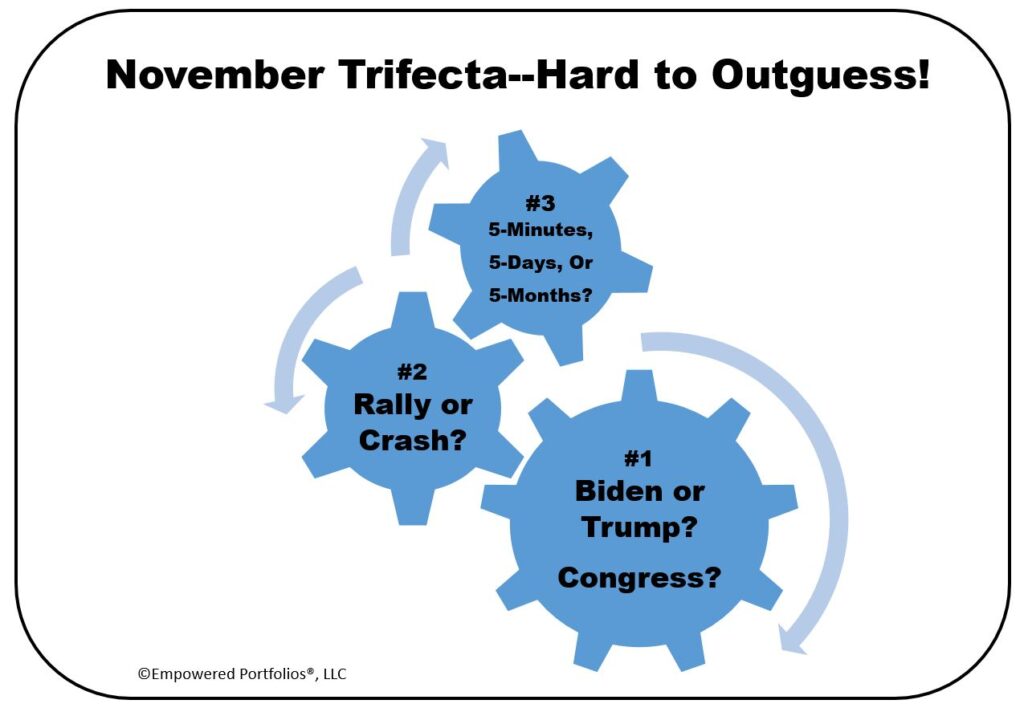

???? Humility is key: That’s why we often start the discussion by pointing out the three BIG UNKNOWNS shown above and by stating our principled view that we’d have to successfully outguess #1, #2, and #3 to improve on pure luck.

So, what if the election results substantially favor one candidate, enough to avoid any legitimate dispute from the losing side, and Congress remains gridlocked?

Would a smooth outcome be the biggest surprise in 2020?

September and October often mark a seasonal period where history-making moments impact markets and the economy: October 1987 and September 2008 quickly come to mind. Do you remember the three short but painful months that spanned September 20, 2018 to December 24, 2018, when the S&P 500 dropped nearly 20%?

The U.S. elections are less than 40 days away, and investors are wondering, if not worrying, about how the potential outcomes will affect the markets, tax policy, trade relations, civil unrest and, most importantly, their family’s future. This time in history, the year 2020, will forever mark a period where humankind was stressed to breaking points–More drama starting November 3rd adds to uncertainty and fear.

We face a season of cloudiness, short-term narratives, and often misleading

signs of what the future will actually bring…

As a trusted fiduciary for clients, Glenwood Financial Partners is committed to the view that BIG events are not the time to bail-out on advice-giving. Instead, we proactively positioned portfolios for BIG/long-term investment themes that matter to ALL clients, regardless of election outcomes.

Including, for example, active investments in companies that challenge the status quo and have the potential to disrupt industries

far more than BIDEN or TRUMP:

⭐ Next Generation Internet & 5G Technology

⭐ Energy Storage

⭐ DNA Sequencing

⭐ Telemedicine

⭐ Artificial Intelligence

⭐ Robotics

⭐ Blockchain Technology

⭐ eSPORTS

Also including, for example, strategic preparations for more controllable decisions and outcomes like:

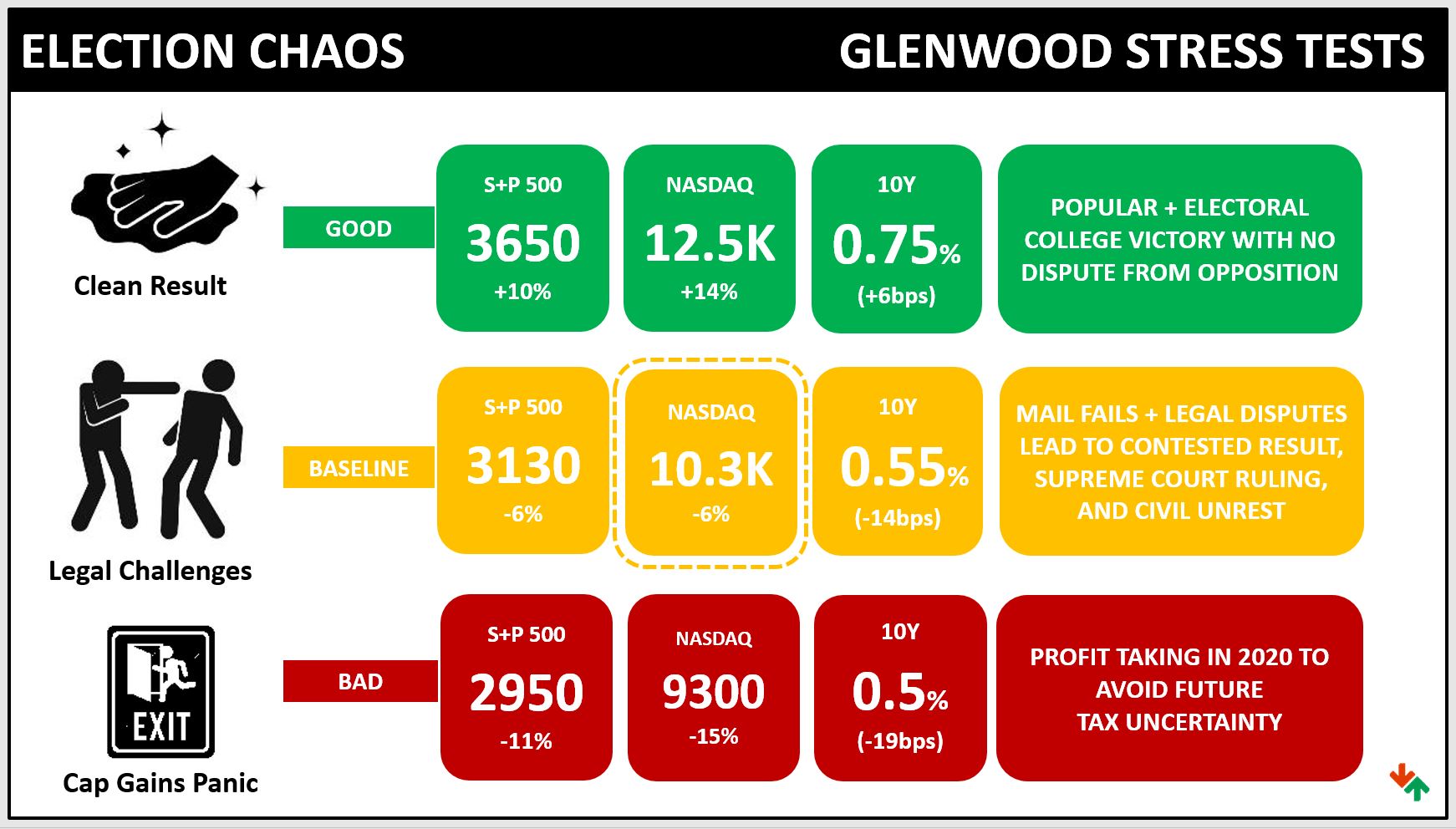

✅ Election Chaos stress tests on every client portfolio

✅ Lower Volatility Holdings added for ballast

✅ Covered Call Strategies to buffer downside risks & add income

✅ FDIC Insured Cash Balances readied for quick electronic transfer to designated banking accounts–Just in Case!

✅ CARES & SECURE ACT knowledge and utilization

✅ Real Estate Mortgages & Personal Balance Sheet moves

✅ Hedged Equity & Higher Yielding investment holdings

✅ Tech, Healthcare & Innovation equity sector weights–HINT, More $$ in these areas & less $$ in old, tired sectors!

As a trusted member of the community, we know that elections produce heightened emotions, uncertainties, and unique economic impacts. So, we are happy to discuss at length our views on how the market is likely to react to various outcomes, how certain key issues may evolve, and provide our perspective on the course of action your family can take prior to November elections.

For starters, we will dig into an organized view of math over emotion. This work will help to illustrate a range of good and bad scenarios on your wealth and retirement assets.

Calculations derived from September 22, 2020 levels on S&P 500, NASDAQ Index, & U.S. 10-YR Bond

Despite the constant, provocative setup by the media and other talking heads for “the most historically important election ever,” there is a reasonable probability for a modest 6-8 week post-election shock at best, and a lose/lose at worst: trades issues on one side, higher taxes on the other.

What is the #1 “opportunity cost” of avoiding worry-lists with too much CASH in portfolios?

POSITIVE SUPRISES: Five areas we do not want you to miss.

#1 High Restocking Demand: Global retail, corporate, and government demand have diminished supplies of all kinds of “stuff.” Massive shifts in consumer behaviors as well as big ticket purchases for homes, autos, and technology will provide sustained benefits to numerous areas of the economy.

#2 Infrastructure Investments: Long promised bridge, road, and building repair could accompany massive investments in mission-critical innovations like 5G and Clean Energy. A suburban housing boom could fuel the urgency.

#3 COVID-19 Success Stories: Vaccine and medical news is welcomed; however, the pandemic has exponentially enhanced innovations across DNA sequencing, artificial intelligence, 3D printing, robotics, cashless banking, and so many other areas that will produce positive announcements for years to come.

#4 Deal-Making: The vast proliferation of negative news creates a magnificent opportunity for positive market-moving events. Strategic corporate combinations, trade-civility, and peaceful geopolitical resolutions may come at any time.

#5 RESILIENCE: Too much CASH in long-term investment portfolios risks missing the benefits of America’s proven grit and ability to lead the world in innovation and thereby produce new revenues, earnings, dividend payouts, interest payments, and stock buybacks.

What will happen to STOCK RETURNS after the election?

BOTTOM LINE

Using the S&P 500 as a key barometer, a next three month performance range of +10% to -11% covers the starting-point scenario outcomes (Good-Baseline-Bad) that we use to stress test every client portfolio. Of course, the specific advice to each family is in the confidential details.

Long-term trends such as a sub-3% economic growth, health care reform, student debt, and large state and federal deficits are going to remain major issues for voters in both November and for years to come. Solutions posed by both sides of an increasingly polarized and populist electorate are likely to have negative investor impacts on at least several of these fronts, if not all, in the years ahead.

Investors have no choice but to manage portfolios, businesses, and balance sheets in an uncertain and often hostile environment. Political events are notoriously unpredictable, so we constantly monitor the risks you are reading and messaging about!

However, instead of reacting to mostly noisy and unpredictable distractions, we rely on time-tested DISCIPLINE & PROCESS to overcome the temptation to try to outguess the November Election Trifecta: RESULTS | REACTION | DURATION.

Proactive investment frameworks, which are led by Michael’s 27 years’ experience as an analyst and strategist are designed to evaluate Reward-to-Risk opportunities with the potential to produce attractive growth and income during various market scenarios.

We look forward to an opportunity for a private chat, so please call us at (919) 268-4100.

P.S. Glenwood’s Fun With Charts features BONUS materials on Election Chaos. We have ambitions for a Netflix-style area of education and information, so your feedback is welcomed and encouraged.

P.P.S. The Future Is Faster Than You Think is a recommended book for those who wish to better understand the impacts of converging technologies on business, industry, and our lives. We summed up a lot in this blog, too: The 6 Ds of Tech Disruption: A Guide to the Digital Economy