Federal Reserve, Banking Concerns, Risk Management Take Center Stage

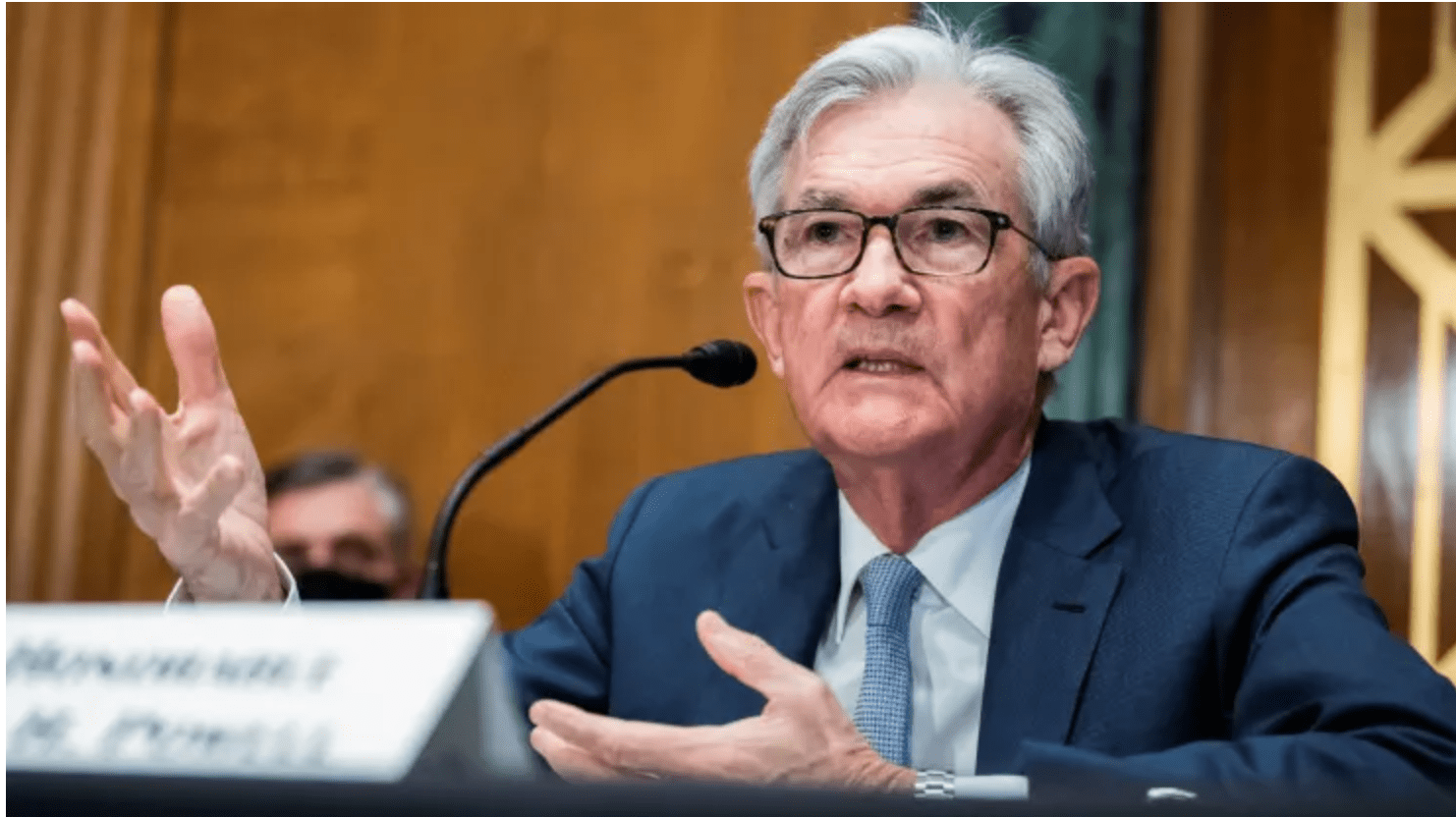

It’s been quite a week. Things seemed fairly normal on Tuesday, March 6, as our Chief Investment Officer, Michael, was in Washington to witness first-hand the testimony of Federal Reserve Chairman, Jerome Powell, before the Senate banking committee. As Michael says, it’s important to feel a part of the process, to observe and listen first-hand, to take notice of the interactions and body language, and to note the off-camera activities of Senators and staffers as our elected and non-elected officials pontificate.

Seated behind Federal Reserve staffers (he’s near the left edge of the photo), Michael had a unique vantage point.

Chairman Powell took on a hawkish tone as he spoke of his resolve to continue to use interest rate increases to combat inflation. His comments created unease in markets, but the unease gave way to worry as reports of the rapid decline of three prominent banks dominated national news. The worry turned to fear in some instances with reports of customer “runs” on the banks before federal officials stepped in to calm the waters early this week.

The week refreshed and hammered home valuable lessons about the importance of risk management. It appears that the three banks certainly could have done better in avoiding risk with their reserves, rising interest rates or not, but all three experienced a similar, seemingly unique convergence of factors not common to the banking system in general. Those factors include, but are not limited to:

- traditional bank structure with a history of success and sizable deposits;

- deposits and withdrawals consisting of U.S. currency;

- no bank ownership of disruptive assets;

- a customer base dominated by institutional customers participating in disruptive segments of the economy;

- banking reserves invested in U.S. treasuries negatively impacted by rising interest rates; and

- perhaps the most damaging of all– customers who could withdraw deposits at the flip of a switch.

Gone are the days of George Bailey and the Bailey Savings and Loan (“It’s A Wonderful Life”) where the bank had a window of time on its side. As an unpredictable crisis became obvious, the Bailey bank closed briefly, not to stop withdrawals crucial to depositors or to insulate the bank from its mistakes, but to give George the chance to slow things down, talk to customers, have them listen to reason, and prevent them from acting purely out of fear. That’s not a bad process to emulate and codify, and we’ve seen hints of that emulation in recent days as the federal government has taken steps to protect bank deposits for a time. But the lesson is clear to banks and others—review and fortify risk management measures.

Of course, the speed of technology has changed everything and led to amazing advances. Algorithms control so much, and many would say too much, as algorithms cannot duplicate the value of human interaction and reasoning. But that’s the world in which we operate and adapt. Maybe there’s a lesson here for modern regulatory innovation. Human interaction, and a window for same, matters.

Turning to the real world in which we at Glenwood Financial Partners work on behalf of clients, we continually acknowledge and consider the full range of the possibilities and the unknowns that impact our work. We cannot have 20/20 foresight, and we hurt for our mistakes, but we can passionately pursue the objective of building and maintaining investment portfolios that withstand the storms. Some investments suffer more damage than others, and some storms hover longer than others, but the emphasis is on discipline, emergence, and perseverance (see or request our “Breaking Bad” commentary from 10/6/2022).

Our reward-to-risk discipline has risen from the shoulders of proven mentors, personal experiences through many storms, and a constant desire to keep getting better on our clients’ behalf. Our greatest personal gratification is the trust that we are shown.

Human behavior has great impact on investment success. With that in mind, we highly recommend a read of Morgan Housel’s wonderful and easily digestible book,The Psychology of Money.

Your questions and discussions are always welcomed and encouraged.