Glenwood Market Insights: Breaking Bad

One of our great mentors always talked about how “the market” puts flesh (explanations) on the bones (true factors) of any given day’s market price action.

The narrative (flesh) regarding Monday and Tuesday’s stock market advances has revolved around the constant hope and predictions as to when the now “hawkish” Fed will pivot “dovish.” But of course, Fed Chair Powell has already addressed this head-on with his read my lips statements on higher and longer lasting interest-rate policy…

We can’t help but have the below image in mind as the Federal Reserve drives their narrative toward a breaking point that we think they will regret. Just one practical point: They have a stated goal of raising the level of unemployment. What part of our working population is that likely to hurt most? I think we can all answer that. But that’s a goal?

We remind you that, other than Chairman Powell, the majority of Federal Reserve Board members have spent their entire careers in academia. On top of that, while we believe in a forward looking “windshield” view, the Fed appears to continuously look in the rearview mirror, seemingly focused on the CPI (Consumer Price Index), where long-term impacts are not to be found.

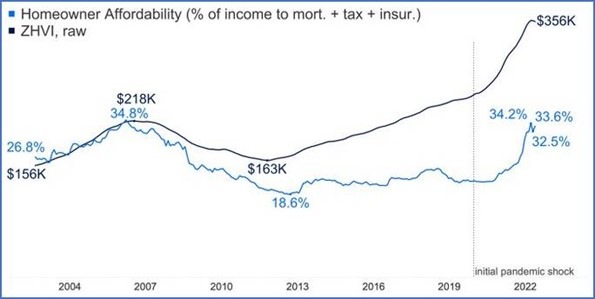

And if the Fed continues to concentrate on CPI, while everything else burns around it, and continues its contribution to the problem that they are exasperating re: housing affordability and new housing construction for builders, then we really do have a problem. The myopic group of academics and their theorems who serve on the Federal Open Market Committee (FOMC) do not appear to live in the real economy and in real time, nor do they appear to be forward-looking with a “windshield” view which indicates fast approaching obstacles.

The recent ISM Index (manufacturing outlook; see chart below) was weaker than expected, including its sub-components. As a result, bond prices got bid up and consequently rates fell as a sign that the Federal Reserve may slow its forecasted rate hike intentions or at least pivot to a “dovish” stance…We Doubt It!

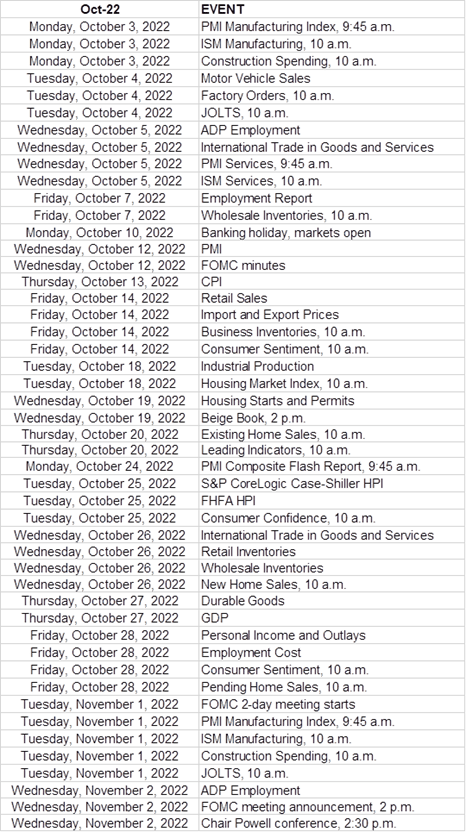

It is important to note the litany of economic data coming out between now and the next FOMC monetary press announcement and report on November 2nd. The Employment Report due Friday October 7th will get the most drum-rolls and drama and, unfortunately, this will need to be reported as “bad news equals good news,” or the markets may react negatively on its release at 8:30AM this Friday.

But, as ridiculous as it sounds, the FOMC appears to be using a “pain” barometer to signal the time for easing its rate-raising mission. How much pain will it take? Consider for instance the painful and dramatic changes already occurring in the Housing Market. There are 70 million people in their prime home buying/house formation years and yet supply has still not come close to matching those needs. So now that problem gets much worse with rising rates and may even cause tremendous INFLATION in Rents, which is the biggest metric in the CPI (Consumer Price Index). Also consider the stated goal of raising the level of unemployment. What part of the working population is that likely to hurt most? That’s a goal?

Zillow Home Value Index (ZHVI): A smoothed, seasonally adjusted measure of the typical home value and market changes across a given region and housing type.

CPI is but one of many important data points to be considered:

The week of October 10th will kick-off 3Q earnings reporting season (see next week’s partial schedule of major companies below) with JP Morgan serving as a “canary in the coal mine” of sorts due to its vast insights and coverage of economic touch points and potential straight-forward commentary from its CEO, Jamie Dimon. As we say (borrowed from Warren Buffett), in the short-term the stock market is a “voting” machine, but in the long-term (see next week) the market is a “weighing” machine as companies report actual, quantifiable results.

Looking farther ahead, Tuesday, November 8th brings mid-term elections, and it appears likely that the party splits at the federal level may create a tougher environment for passing legislation. In typical years, the difficulty of passing new legislation and spending bills is a market positive. Is this a typical year? Time will tell, but there’s a glimmer.

In this era of Executive Orders, sneaky tricks, presidential health issues, and geopolitical risks, it’s difficult to handicap any net positive or negative results, no matter what comes down the pike, and we currently put more weight on the Risk Management side of our strategy.

Longer-term, however, we navigate the current environment with the continuing outlook that the future will be brighter than most think today. Our “windshield” view leads us to the humble opinion that the future will reveal some remarkable progress being made for the benefit of mankind, despite the-best laid plans of authorities to constantly fight common sense.

Discipline, process, and patience will continue to guide.

There’s so much more to say, but enough said…. “We have to go through a correction to get back to that place.” – Federal Reserve Chair Jerome Powell

Questions/Discussion welcome. We’re educators & collaborators.