Tucker, an actual client, values his hard-earned assets!

The S&P 500 and Dow Jones Industrials continue to register new all-time highs. Glenwood Financial Partners continues to urge investors to know the risk profile of their investment portfolios, or at the very least to feel confident that wealth advisors are working for their best interests. Rising markets can hide a lot of sins, and we are concerned that the use of overly standardized mutual fund models will negatively surprise investors with added expenses and tax burdens.

Michael Hakerem, CFA®, our chief investment officer, is a pioneer in goals-based wealth management that is properly integrated with customized portfolio construction. He has been building multiple asset class portfolios since 1994 and received his chartered financial analyst designation in 1998. We are passionate that clients deserve, require, and desire better client-focused solutions. Proper portfolio construction is critical to maximizing the benefits of various investment solutions, and our team has developed tools and methods to continuously review unique client portfolios for rewards and risks, total expenses, and tax burdens.

Despite the headlines of new all-time stock market highs, today’s investors face multi-faceted challenges. Some challenges and uncertainties are more controllable than others. Increased longevities mean increasing retirement years to fund. Expenses for healthcare, assisted living, and college seem to inflate year-end and year-out. Plus, there is a lot of fun stuff we would all like to enjoy! It can be a challenge to pivot around hidden expenses and tax consequences!

Higher capital gain tax burdens from some mutual funds are compounding problems that eat into nest eggs and cash flows. The capital gains estimate season is early on; however, we have flagged hundreds of mutual funds with significant distributions. Already higher than all of last year, we expect this list to grow. In this environment, investors should demand more cost effective and tax efficient portfolio management to make their hard-earned wealth work hard, too. Even tax-sheltered accounts can be burdened by the negatives occurring in the mutual fund product type. Glenwood Financial Partners implements portfolios to help clients address these challenges, and we know that unanticipated tax bills are troublesome.

Below are several ways we help.

- Communicate, Communicate, Communicate. We proactively reach out to our clients and their tax adviser. We are available 24/7 to discuss strategies, listen to your concerns, and provide plain language analysis and explanations.

- Utilize carefully selected Exchange Traded Funds, commonly known as ETFs. While often more tax efficient than mutual funds, ETFs must be analyzed for a wide range of potential expenses, trading costs, weighting methods, and potential hidden risks.

- Constantly monitor selected mutual fund holdings. Our chief investment officer helped run a four-star mutual fund in the 1990’s, so we use that intimate knowledge to analyze 50 critical data points on a weekly basis. We also have direct lines of communication with the analysts, portfolio managers, and key personnel who run the funds held in our clients’ investment accounts.

- Allocate investment dollars to individual stock and bond securities where suitable. We can often gain appropriate diversification and flexibility as well as better control for expense and tax budgets.

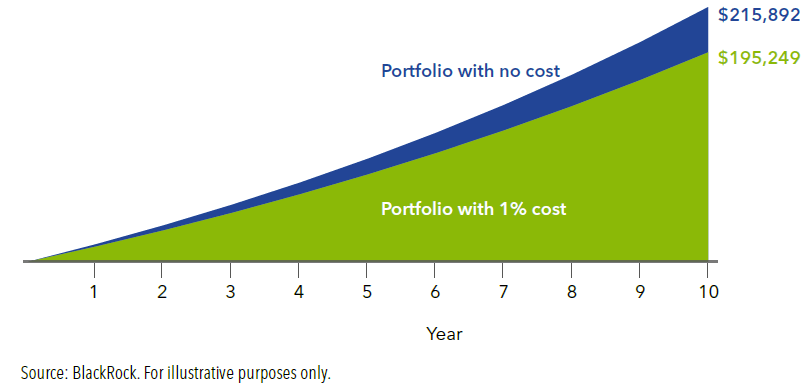

Glenwood Financial Partners is total-fee conscious, and we target investments that will add value in exchange for known costs. At an additional 1% cost, 10% of your total investment potential could be lost to fees. (The graph below assumes an initial investment of $100,000)

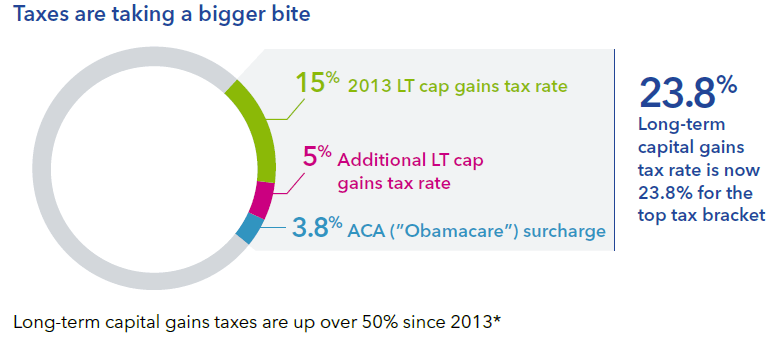

It’s what you keep that counts, so discerning investors should focus on the after-tax returns of their investments. Glenwood carefully manages portfolios with a focused goal to limit capital gains distributions from mutual funds so that you can keep more of YOUR hard-earned wealth. Tax year 2017 is likely to be another frustrating year of “uncontrollable” capital gains distributions from mutual funds.

According to the IRS, in 2013, the maximum long-term capital gains tax rate was increased from 15% to 20%, plus an additional 3.8% for investors in the highest income bracket.

It’s Simple. We build core and complementary portfolios that meet unique circumstances and specific investment goals. We focus on risk management. In a low yield, high tax environment, every dollar counts. Managing rewards, risks, fund expenses, and tax budgets can greatly enhance a portfolio’s long-term returns. Accordingly, Glenwood’s wealth management philosophy is to discourage the use of overly standardized mutual fund-only portfolios, particularly in taxable accounts. While mutual fund-only portfolios may serve time-efficiency objectives of financial advisors, we do not believe that they serve the best interests of ALL clients.

In summary, while we believe that the selective use of mutual funds has a place within our client portfolios, it is our conviction, supported by our unique stress-testing technology, that the challenges of mutual funds are best minimized through customization, selectivity, allocations to individual stock and bond securities, and to cost-efficient Exchange Traded Funds (ETFs).

Today and tomorrow, our goal is to help you live your best life. Please consider us welcoming resources for any question or discussion in plain language. We believe in a forthright and caring approach, and we are always delighted to talk things over. We want to think better, do better, and serve better.

Your situation can be analyzed with expertise, so Email us or call at (919) 268-4101.

The information set forth herein is for informational purposes only and should not be used as the sole basis for an investment decision. While we have made every attempt to ensure that the information contained in this Site has been obtained from reliable sources, we are not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this Site is provided “as is,” with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information, and without warranty of any kind, express or implied.