Some of you will recall that in October, 2022, we could not help but have the below image in mind as the Federal Reserve Board drove their narrative toward a breaking point that we thought they would regret: A stated goal of raising the level of unemployment significantly. And we asked ourselves: What part of our working population is that goal likely to hurt most? I think we can all answer that, but, fortunately, the goal has not been reached, and may prove to be unattainable.

We believed back then, as always, in a forward looking “windshield” view, while the Fed appeared to continuously look in the rearview mirror with a focus on the CPI (Consumer Price Index) where long-term impacts cannot be measured.

The Federal Reserve Board’s August 26, 2023 meeting is almost upon us, and while some are pricing-in another rate increase, we will not outguess the next move.

In any event, with the recent pause in rate manipulation, longer-term impacts have played out such that the inflation goal of 2% annually may be close at hand. The question still lingers, to what extent has inflation been “transitory” rather than systemic? And we would add the question, to what extent has inflation included what we call “greed”-flation? But those questions are beside the point. The point is that economic factors are working through the system, and inflation, transitory or not, is subsiding. Of course, the rates of inflation today are based upon comparisons to significant price increases that were already in place twelve months ago, and those increases remain real and impactful, but the slowing of price increases is a welcome relief for sure.

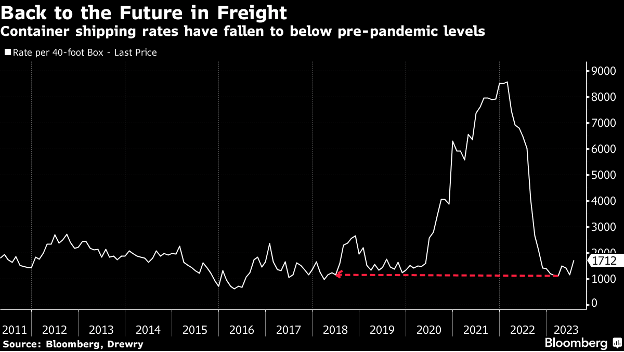

In many cases, the surge in costs of the past that had many ripple effects also stimulated innovative solutions and new logistic strategies that we expect will provide nice paybacks in the future. For example, as indicated below, container shipping rates which shot up so quickly have fallen to below pre-pandemic levels.

So, there’s light in the tunnel. Whether it’s at the end of the tunnel, we cannot say for sure, but we see it as a positive light for sure. Markets are in recovery, and the S&P 500 was up about 24% from its close of October 13, 2022, through the close of July 25, 2023.

There are so many “what-ifs”, and we cannot out-guess all of those, but whatever the short-term brings us next, we continue to believe that patience will, once again, allow us to see a return to our prior market highs and exceed them. Below are a few of the timeless investment principles that we intend to follow and recommend:

- Long-Term Mindset: Approach investing with a long-term horizon, and don’t be swayed by short-term market fluctuations.

- Don’t Time the Market: Avoid trying to predict short-term market movements and focus on long-term trends.

- Keep Emotions in Check: Avoid making impulsive decisions based on fear or greed.

- Don’t Over-Diversify: Concentrate on your best ideas rather than spreading your investments too thinly.

- Be Rational, Not Optimistic: Base your investment decisions on rational analysis rather than blind optimism.

- Stay Humble: Acknowledge mistakes, learn from them, and move on.

- Be Tax-Efficient: Consider tax implications when making investment decisions.

- Ignore Market Noise: Tune out short-term market fluctuations and focus on your long-term investment strategy.

- Manage Risk: Understand and manage the risks associated with your investments.

- Be Independent-Minded: Form your own investment conclusions rather than blindly following others.

Successful investment management requires a continuous thirst for knowledge and the willingness to adapt to changing market conditions. It’s essential to conduct thorough research and analysis before making investment decisions.

We welcome all questions. We are educators at heart.

The information contained herein is for informational purposes only and is developed from sources believed to be providing accurate information. The opinions expressed are those of the author, are for general information, and should not be considered a solicitation for the purchase or sale of any security. The decision to review or consider the purchase or sell of any security should not be undertaken without consideration of your personal financial information, investment objectives and risk tolerance with your financial professional.

Forecasts or forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice.

Any market indexes discussed are unmanaged, and generally, considered representative of their respective markets. Index performance is not indicative of the past performance of a particular investment. Indexes do not incur management fees, costs, and expenses. Individuals cannot directly invest in unmanaged indexes. The S&P 500 Composite Index is an unmanaged group of securities that are considered to be representative of the stock market in general.

Past Performance does not guarantee future results.

Investment advice offered through Eudaimonia Partners, LLC, a registered investment adviser.