“Believe nothing you hear, and only

one half that you see.” – Edgar Allan Poe

We’ve all heard financial commentators on TV and podcasts declaring, “The easy money has been made.” We strongly dislike that phrase because, first of all, there is no “easy money” in our view, and, second, those who use that phrase are often having to explain the underperformance that they have delivered for their clients by trying to out-guess markets rather than working a patient, disciplined approach.

Engagement with financial markets poses many challenges. At Glenwood, we genuinely value our clients’ patience and discipline, acknowledging their pivotal role in realizing their unique investment objectives. Wealth management transcends mere finances; it encompasses values, traditions, knowledge, memories, and more. Be sure to read to the end and explore our latest suggestions for enjoyable reading and listening.

Our Chief Investment Officer, Michael Hakerem, holds the position of Triangle Regional Director at the CFA Society North Carolina, featuring over 1,500 members. In this capacity, he recently visited with two distinguished firms, PIMCO and Dimensional. With a substantial $1.9 trillion and $690 billion under management, respectively, these industry giants bring significant insights.

With a combined 93 years of advising institutional and private investors, each of these firms refrained from offering easy money quotes. Instead, they underscored the shared challenges we all encounter in predicting inflation, interest rates, stock markets, and the pivotal human behaviors that shape investment outcomes.

As a veteran financial advisor and long-time member of the NC Bar Association Investment Committee, Rick McElroy can tell you first-hand that the hard work required of discipline, process, and true customization has provided a steady road to the financial future while calming the emotional roller coaster of “expert” predictions and speculation.

Like Yogi Berra said, “it’s tough to make predictions,

especially about the future.”

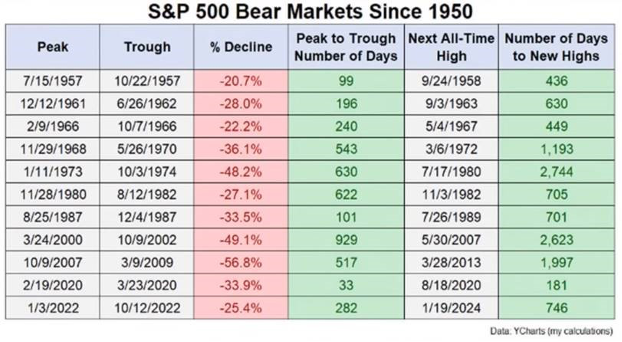

The table above tracks significant -20%+ declines in the S&P 500, known as bear markets, and the time it took to reach the next all-time high. The S&P 500’s 746 days to reach a new high in 2024 and the unexpected Federal Reserve interest rate hikes in 2022 highlight the complexities of investing. Bear Markets are not easy, especially when bond prices also decline instead of providing a cushion to stock market downturns.

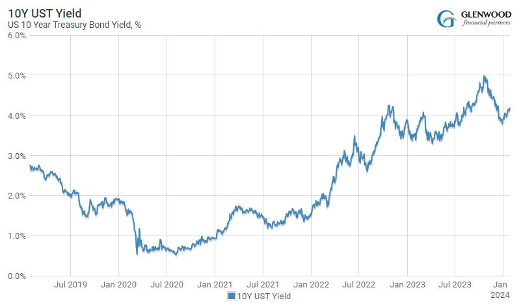

Feel free to reach out to us for a clearer understanding of the intricate dynamics between bond prices and interest rates. Meanwhile, take note below of the remarkable shifts in the well-known 10-year U.S. Treasury Bond’s yield before/during/after the latest stock market Bear Market—these interest rate changes have implications for primary home mortgages, HELOCs, real estate and stock valuations, and beyond. The key 10-year interest rate nearly approached zero in 2020 and briefly touched 5% in 2023, highlighting the massive shifts that impact credit and equity markets.

Speaking of Rates-The Federal Reserve is Back in the News this Week

Amid discussions on the Fed’s potential rate cuts in 2024, it’s crucial to note that monetary policy isn’t the sole driver of stock returns. A strong fundamental economy and rising earnings often matter more than the number of rate cuts. In fact, and despite many a prognosticator’s provocative headlines, the U.S. economy, corporations, and consumers have a remarkable knack for resilience and innovation!

OVER and OVER again…What’s the Fed going to do? Does Jerome Powell look happy? What did he really mean by that statement? Ugh! Does it matter how many times the Fed cuts rates in 2024, or if they even cut rates at all? Some market commentators have us believe that is the case OR ELSE guaranteed gloom and doom! Glenwood has even written about the Fed and Jerome Powell Breaking Bad (posted at glenwoodfp.com).

Referring to our opening Edgar Allan Poe quote, we’ve heard over and over about a guaranteed recession and reasons for yet another stock market crash. We’ve all seen the massive evidence that doom is just around the bend, right? Remember when Federal Reserve Chairman Powell looked into the camera back in 2021 and said the Fed probably would not raise rates in 2022 and the FOMC’s so-called Dot Plot publicly released illustration showed the same expectation on paper? What really happened? The Federal Reserve raised its benchmark interest rate 11 times across 2022 and 2023.

Fortunately, stock returns are influenced by more than just monetary policy, and the Federal Reserve doesn’t wield absolute power over the stock market. Ultimately, a robust fundamental economy and increasing earnings hold greater significance than the number of rate cuts in 2024—be it two, three, five, or none. History attests to this.

This Friday, the groundhog will reluctantly emerge from its lair, assessing the evidence for the presence or absence of its shadow. It will likely dismiss any speculation about an early spring, at least for the next six weeks. According to USA Today, the groundhog has made this prediction in 107 of the last 127 years, or 84% of the time. The Weather Channel predicts “considerable cloudiness” over Punxsutawney, PA on February 2nd, possibly favoring a more positive outcome.

Preceding this event is the Federal Reserve’s statement and Chair Powell’s press conference on Wednesday. A similar conclusion is expected. After reviewing the available evidence, the committee deems it premature to discuss monetary easing and encourages tuning in to their next meeting in six weeks.

Patience Over Speculation

Instead of trying to predict stock market outcomes or Fed policy shifts, we emphasize the importance of patience and discipline. We often draw an analogy between investing and driving on I-40 for our clients. While some may constantly switch lanes hoping for a faster route, Glenwood prioritizes safety and defensive driving when guiding our clients toward their unique goals.

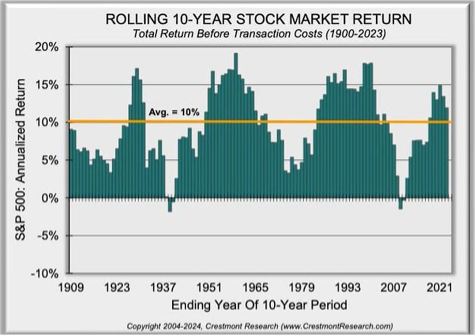

The stock market’s average annualized “speed” since 1900 is approximately 10%. However, as illustrated below, there’s rarely a consistent average speed during any specific measurement period.

Reading and Listening:

Highly Recommended for You, Your Children & Friends, and Your Enemies!

Doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people.

Respect and Admiration (only 11 minutes-be sure to listen to the end for a great Buffett quote)

From our friend Morgan Housel who was kind enough to be a guest at Michael’s CFA Society webcast, “Just after my son was born, I wrote a few things I thought he’d find helpful as an adult. One of them was you might think you want an expensive car, a fancy watch, and a huge house. But I’m telling you, you don’t. What you want is respect and admiration from other people, and you think having expensive stuff will bring it. It almost never does – especially from the people you want to respect and admire you. Eight years later I still believe this to be true, and I might even double down.”

What’s Really Important

Michael and his three boys celebrate the most valuable commodity…

Time with each other!

Rick and his 15 Treasures!

SCHEDULE YOUR CONFIDENTIAL CHAT

We appreciate all our friends and collaborators that help make Glenwood’s mission possible; after all, Wealth Management – it’s not just money. It includes values, traditions, knowledge, memories, and so much more.

And to all of our non-client friends, we welcome you to a cordial update discussion of our continuing investment discipline and our commitment to a truly personalized relationship with each and every client.

3717 National Drive, Suite 211

Raleigh, NC 27612

919-268-4100

www.GlenwoodFP.com

Important Information

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Glenwood Financial Partners is a d/b/a of Eudaimonia Partners, LLC. Investment advisory services offered through Eudaimonia Partners LLC, a registered investment advisor. Advisory services are only offered to clients or prospective clients where Glenwood Financial and its representatives are properly licensed or exempt from licensure.

For additional information, please visit our website at https://www.glenwoodfinancialpartners.com/.